Companion Animal Diagnostics Market Size to Reach USD 14.47 Billion by 2034

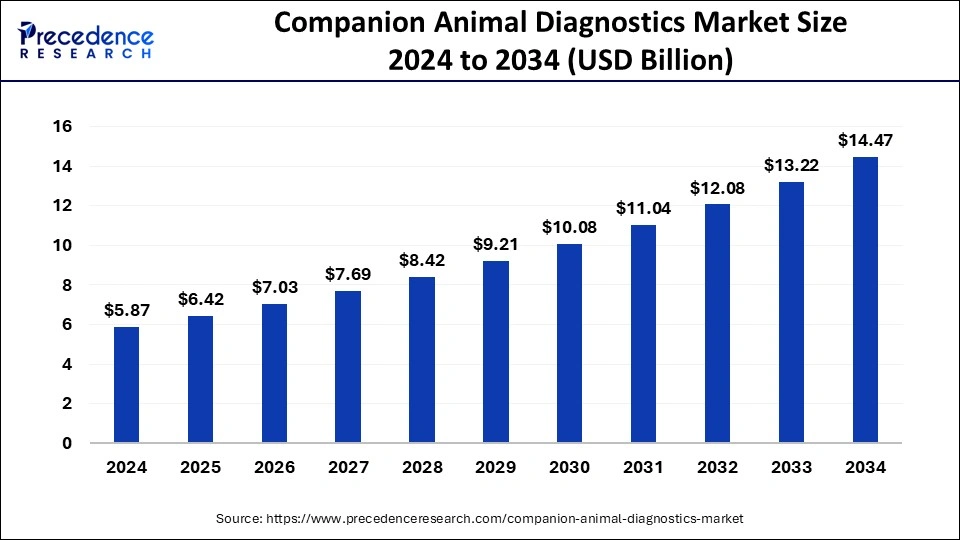

According to Precedence Research, the global companion animal diagnostics market size will grow from USD 6.42 billion in 2025 to nearly USD 14.47 billion by 2034, with an expected CAGR of 9.45% from 2025 to 2034. In 2024, North America led the market with more than 50% of market share, while Asia Pacific emerged as the fastest-growing region.

Ottawa, Oct. 22, 2025 (GLOBE NEWSWIRE) -- The global companion animal diagnostics market size is expected to reach nearly USD 14.47 billion by 2034, increasing from USD 6.42 billion in 2025 and is projected to grow at a notable CAGR of 9.45% from 2025 to 2034. The rising adoption of pet insurance, innovation in companion diagnostics, and favorable government initiatives are driving the market's growth.

The Full Study is Readily Available | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/4387

Companion Animal Diagnostics Market Highlights:

- In terms of revenue, the global companion animal diagnostics market was valued at USD 5.87 billion in 2024.

- It is projected to cross USD 14.47 billion by 2034.

- The market is expected to grow at a solid CAGR of 9.45% from 2025 to 2034

- North American accounted for the largest market share of 50% in 2024.

- Asia Pacific is growing at a significant CAGR during the forecast period.

- By animal type, the dogs segment held the major market share in 2024.

- By animal type, the equine segment is expanding at a notable CAGR over the projected period.

- By application, the clinical pathology segment contributed the highest market share in 2024.

- By technology, the clinical biochemistry segment dominated the market in 2024.

- By technology, the molecular diagnostics segment is growing at a strong CAGR over the projected period.

- By end-use, the laboratories segment dominated the market in 2024.

- By end-use, the veterinary hospitals & clinics segment is projected to expand significantly over the forecast period.

What is Companion Animal Diagnostics?

Companion animal diagnostics refers to the suite of tools and tests used to detect, monitor, and manage health conditions in pets like cats, dogs, and other household animals. These diagnostics include pathogen detection, genetic testing, imaging, and blood tests, which are all designed to provide veterinarians with timely, accurate information about an animal's health status. A companion diagnostic is a medical device, which may be an in vitro diagnostic (IVD), that provides information that is necessary for the safe and effective use of a corresponding drug or biological product. Companion diagnostics can monitor the response to treatment with a specific therapeutic product for the purpose of adjusting treatment to achieve effectiveness or improved safety.

The benefits of companion animals' diagnostics include early detection, which identifies health issues in their early stages, and can enhance treatment outcomes and significantly extend the pet’s quality of life. Companion animal benefits include giving a sense of purpose for pet parents, creating a calming presence, providing unconditional love and support, easing feelings of loneliness, and helping to reduce stress and anxiety.

➡️ Become a valued research partner with us ☎ https://www.precedenceresearch.com/schedule-meeting

Latest Private Industry Investments in Companion Animal Diagnostics

-

MI: RNA Diagnostics — Series A $4 million - In mid-2024, MI: RNA, a veterinary diagnostics company using microRNA biomarkers and AI for early disease detection in pets, equine, and livestock, raised USD 4 million in a Series A round. Investors included NovaQuest (lead), Kyoritsu Holdings, Veterinary Angel Network (VANE), Animal Health Angels, Companion Fund I, Gabriel, Equity Gap, and Scottish Enterprise.

-

Mars / Digitalis Ventures — Companion Fund II ($300 million VC fund) - In October 2023, Mars, Inc., together with Digitalis Ventures, launched Companion Fund II, a USD 300 million fund to back startups in the pet care space, including those working on veterinary diagnostics. This offers capital for early and growth-stage companies developing diagnostic tools, vet medicine, digital platforms, etc.

-

Advanced Animal Diagnostics — $7 million investment - Advanced Animal Diagnostics (AAD), which builds diagnostics and data systems for animal health, raised USD 7 million to expand its platform (originally for livestock diagnostics) into applications with human health overlap (e.g., COVID-19 diagnostics), but the investment also supports its animal health diagnostics business.

-

Anivive Lifesciences — $20 million investment - Anivive, a biotech company developing vaccines, therapeutics, genetic analysis, and AI imaging for pets, secured USD 20 million from Leonid Capital Partners to commercialize its vaccine candidate for valley fever and to grow its diagnostic / imaging capabilities.

-

Vetigenics — $6 million private equity / VC funding - Vetigenics, a biotech firm focused on antibody therapeutics for pets, recently raised USD 6 million from private equity investors to advance its product pipeline, including diagnostics/treatment-detection tools in cancer and other pet diseases.

What are the Key Trends of the Companion Animal Diagnostics Market?

-

Growth of Point-of-Care (POC) Testing: There is increasing demand for diagnostics that deliver rapid results in the clinic (or even at home), reducing turnaround times and enabling veterinarians to make treatment decisions more quickly.

-

Integration of AI, Machine Learning & Digital Technologies: Artificial intelligence, machine learning, and digital tools are increasingly being used to enhance diagnostic accuracy, assist in image analysis (radiology, cytology), enable predictive analytics, and facilitate remote diagnostics or decision support.

-

Expansion of Molecular Diagnostics & Advanced Biomarkers: Diagnostics based on molecular methods (e.g., PCR, next-generation sequencing), multiplex assays, and new biomarkers are becoming more common, allowing for earlier detection of infectious agents, genetic or hereditary conditions, and more precise disease staging.

-

Preventive Care, Wellness & Early Detection: Pet owners are increasingly treating their animals like family, pushing for wellness checkups, preventive diagnostics (e.g., screening for disease before symptoms appear), routine monitoring of chronic conditions, and overall earlier disease detection.

-

Diversification & Expansion of Services and Consumables: The market is seeing growth not only in better diagnostic instruments but also in consumables like reagents, kits, and lateral flow assays; an expansion in testing categories (clinical chemistry, cytopathology, imaging, etc.); growth in service-based diagnostics (lab reference services), and geographical expansion into emerging markets.

➤ Obtain the Complete Report @ https://www.precedenceresearch.com/companion-animal-diagnostics-market

Companion Animal Diagnostics Market Opportunity

Greater Spending on Veterinary Care

Greater spending on veterinary care is an opportunity for the market. The costs of veterinary healthcare, its impact on public health and animal welfare, and the broader economic benefits of investing in veterinary services. Increasing investment in veterinary education and research to improve medical knowledge. Rising costs of veterinary care are due to emergency & critical care services, long-term health management, preventive care, antimicrobial resistance management, pharmaceutical costs, specialized veterinary training, and innovation in medical technology.

Companion Animal Diagnostics Market Key Challenges

Shortage of Skilled Veterinarians

Shortage of skilled veterinarians can limit the growth of the market. Number of issues arising from veterinary professional shortages, including economic impact, reduced access to services, increased workload for existing staff, and impact on animal welfare. The rising workload and staff shortages can lead to burnout and impact the quality of care provided, making workforce management a top priority for veterinary practices. Without qualified veterinarians and veterinary nurses, food safety may be threatened.

Companion Animal Diagnostics Market Scope

| Report Attributes | Statistics | |

| Market Size in 2025 | USD 6.42 Billion | |

| Market Size in 2026 | USD 7.03 Billion | |

| Market Size by 2034 | USD 14.47 Billion | |

| CAGR from 2025 to 2034 | 9.45% | |

| Dominated Region in 2024 | North America | |

| Fastest Growing Region | Asia Pacific | |

| Base Year | 2024 | |

| Forecast Period | 2025 to 2034 | |

| Segments Covered | Technology, Animal Type, Application, End-use, and Regions | |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa | |

Set up a meeting at your convenience to get more insights instantly! https://www.precedenceresearch.com/schedule-meeting

How North America Dominated the Companion Animal Diagnostics Market?

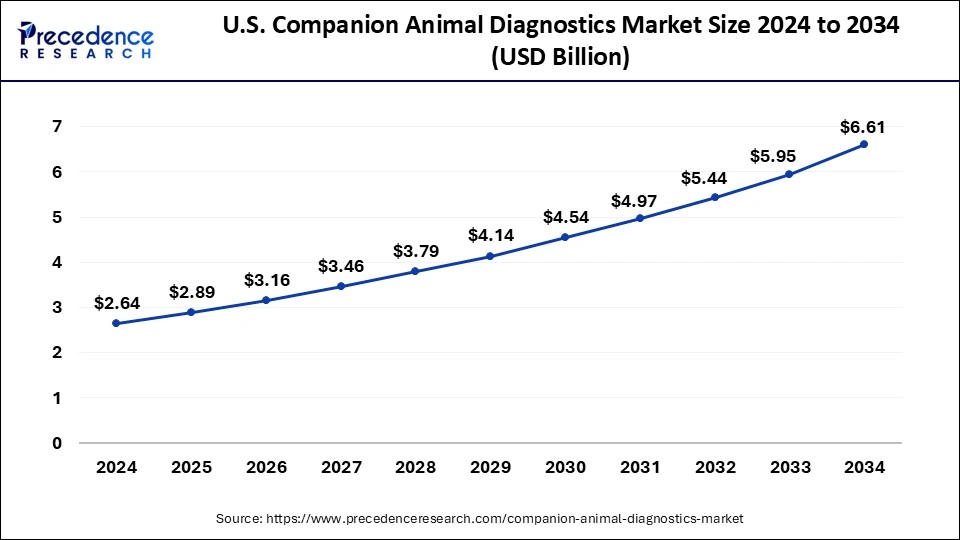

North America dominated the global market in 2024 due to the rising prevalence of zoonotic diseases and foodborne diseases, innovation in companion diagnostics, suitable government initiatives, reducing the chances of human error, and the rising adoption of pet insurance in the region. The growing pet population and pet ownership & their investments in cutting-edge diagnostics, are fostering the market. The existence of key market layers and the expansion of specialized imaging services are increasing accessibility of advanced companion animal diagnostics across the North American animal health care infrastructure. Moreover, the rising demand for sophisticated tools is leveraging significant innovations and developments.

The U.S. dominates the regional market due to its large pet-owning population with high healthcare spending, advanced veterinary infrastructure, and a strong culture of preventive and wellness care. Leading global companies like IDEXX, Zoetis, and Heska are headquartered in the U.S., driving continuous innovation in diagnostic technologies such as point-of-care testing, molecular diagnostics, and AI-powered tools. Robust investment ecosystems and well-established distribution networks further accelerate product development and adoption, while a clear regulatory framework and highly trained veterinary professionals support rapid integration of new diagnostics into clinical practice, solidifying the U.S.’s leadership in the region.

- In December 2024, a significant update reflecting its commitment to innovation and excellence was unveiled by IDEXX Laboratories, a global leader in veterinary healthcare. From leadership changes to innovative diagnostic tools, the company continues to improve the well-being and health of livestock, pets, and people. (Source: https://nuffoodsspectrum.in)

What is the Companion Animal Diagnostics Market Size?

The U.S. companion animal diagnostics market size is worth more than USD 2.89 billion in 2025 and is projected to cross around USD 6.61 billion by 2034, expanding at a CAGR of 9.61% from 2025 to 2034.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Try Before You Buy – Get the Sample Report@ https://www.precedenceresearch.com/sample/4387

Why is the Asia Pacific the Fastest Growing in the Companion Animal Diagnostics Market?

Asia Pacific is expected to host the fastest-growing market in the coming years because spending on pet healthcare, rapid tests are becoming more popular among end users, technological advances in areas like portable devices, AI, & molecular diagnostics, rising awareness of animal health, and suitable diagnostic tools for point-of-care (PoC) services in the region.

The growing pet ownership and urbanization are contributing to this growth. The growing trend of pet humanization has increased spending on animal healthcare in Asian countries like China, India, and Japan. The strong focus on the development of point-of-care devices for faster and accurate outcomes and integration of AI in diagnostic platforms is leading this growth.

- In March 2025, the first advanced nuclear medicine diagnostic center in a public hospital with IAEA support, significantly increasing access to diagnostic services for cancer and other non-communicable diseases, was recently opened by the Kingdom of Jordan. The new PET-CT equipment at AI-Bashir Hospital in Jordan will increase access to innovative nuclear medicine services. (Source: https://www.iaea.org)

China is leading the regional market, driven by country leadership stemming from its rapidly increasing pet ownership, fueled by urbanization and a growing middle class with higher disposable incomes, which drives greater spending on pet healthcare. Additionally, China has been investing heavily in veterinary infrastructure, including diagnostic laboratories and advanced technologies like molecular diagnostics and point-of-care testing. Strong government support for the animal health sector, increasing awareness about preventive pet care, and strategic partnerships between domestic and international companies further accelerate market growth, making China the dominant player in the region.

Companion Animal Diagnostics Market Segmentation Insights

Technology Insights

Which Technology Segment Dominated the Companion Animal Diagnostics Market?

The clinical biochemistry segment dominated the market in 2024. Biochemical examinations provide a comprehensive understanding of an animal’s health by assessing many parameters, such as nutritional deficiencies, metabolic processes, and organ function. Animal biochemistry provides insights into the metabolism and other biochemical processes that are necessary for the health and well-being of animals. Animal biochemistry plays an important role in the diagnosis and treatment of animal diseases in veterinary healthcare.

The molecular diagnostics segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. Molecular diagnostics proved to be better in the detection, management, control, and eradication of animal suffering caused by many infectious and non-infectious diseases. A robust and sensitive assay can provide more useful information. Molecular testing solutions are rapidly transforming in disease detection and infection control. They allow accurate, fast diagnoses right at the site of care for a range of common infectious diseases, enabling the differentiation of infections with similar symptoms.

Animal Type Insights

Which Animal Type Leads the Companion Animal Diagnostics Market in 2024?

The dogs segment led the market in 2024, as the dogs specifically have been proven to encourage exercise, ease loneliness, anxiety & depression, reduce stress, and improve our overall health. With stress and burnout rates on the rise, having a furry friend waiting for us at home is scientifically proven to enhance our mental and physical health. Dogs are a source of companionship and comfort for their owners, but the degree to which this may translate into real emotional and social support has not been quantified.

The equine segment is projected to experience the highest growth rate in the market between 2025 and 2034. Basic information on companion animal and equine research allows for more directed measures to enhance conditions for research within the area. Modern mobile diagnostic imaging technology has transformed equine veterinary care, enabling more accurate and detailed evaluations conducted directly at the location. Equine ultrasounds are high-resolution, portable, and produce clear and detailed images.

Application Insights

Which Application Leads the Companion Animal Diagnostics Market?

The clinical pathology segment led the market and is set to experience the fastest rate of market growth from 2025 to 2034. Veterinary pathologists advance animal and human health through disease diagnosis. Disease diagnosis in companion, food-producing, and zoo/wildlife animals is central to the discipline of veterinary pathology, and it is essential to the health of our pets and our food supply, as well as to the conservation of wildlife species. A veterinary clinical pathologist is a veterinarian who studies diseases in animals, tissue & fluid samples, examines blood, and conducts laboratory tests that help to confirm or reveal a diagnosis of what may be wrong with a pet.

End-use Insights

What Made Laboratories Dominate the Companion Animal Diagnostics Market?

The laboratories segment dominated the market in 2024. Diagnostic laboratory testing tracks our pet’s progress over time, helping us assess the effectiveness of treatments and make essential adjustments. A quick result can save the animal’s life in an emergency or improve anesthetic safety. In-house diagnostics provide speedy results. These laboratories play an important role in early detection, accurate diagnosis, and effective treatment of many medical conditions, ensuring our pet receives the best possible care.

The veterinary hospitals & clinics segment is anticipated to grow with the highest CAGR in the market during the studied years. Choosing an independent veterinary clinic for our pet can offer many benefits, including better continuity of care, affordability, more control over services, local involvement, and personalized care. Veterinary clinics focus on preventive medicine and wellness checks for pets and can perform minor surgical procedures. Veterinary clinics may be smaller than animal hospitals simply because the scope of services they provide is more limited.

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

Companion Animal Diagnostics Market Top Companies Top Companies

-

AniCell Biotech – AniCell Biotech specializes in regenerative therapies for animals, providing diagnostic solutions that support early detection and monitoring of joint and soft tissue conditions in companion animals.

-

Randox Laboratories Ltd. – Randox Laboratories offers a wide range of veterinary diagnostic tests and equipment, including biochemistry analyzers and biomarkers tailored to companion animal health.

-

bioMérieux SA – bioMérieux provides advanced microbiology and molecular diagnostic tools that help veterinarians detect infectious diseases in companion animals quickly and accurately.

-

NEOGEN Corporation – NEOGEN offers a comprehensive portfolio of diagnostic products, including rapid test kits and ELISA-based assays for identifying pathogens and allergens in companion animals.

-

IDVet – IDVet develops and manufactures innovative diagnostic kits based on ELISA and PCR technology for the detection of infectious diseases in companion animals.

-

VCA, Inc. – VCA, Inc. operates a network of veterinary hospitals and diagnostic laboratories offering in-house and reference lab services that enable comprehensive health screening for pets.

-

Virbac SA – Virbac provides diagnostic solutions alongside its therapeutic products, supporting veterinarians in disease identification and treatment planning for companion animals.

-

Abaxis, Inc. – Abaxis, now part of Zoetis, is known for its VetScan diagnostic instruments, which deliver rapid, reliable results for blood chemistry and hematology in companion animal practices.

-

Thermo Fisher Scientific, Inc. – Thermo Fisher offers a wide array of diagnostic tools, including molecular and immunoassay technologies, to aid in disease detection and research in companion animals.

-

Heska Corporation – Heska designs and manufactures diagnostic instruments and consumables such as blood analyzers and allergy testing kits focused on improving veterinary care for companion animals.

-

Zoetis Inc. – Zoetis provides a robust diagnostic portfolio, including point-of-care analyzers and molecular tests, enabling veterinarians to make informed clinical decisions for companion animals.

- IDEXX Laboratories, Inc. – IDEXX is a global leader in veterinary diagnostics, offering an extensive range of lab services, in-clinic testing, and digital tools designed specifically for companion animal healthcare.

Recent Developments

- In March 2025, the launch of truRapid FOUR, a comprehensive in-house canine vector-borne disease (CVBD) screening test, was announced by Antech, a global veterinary diagnostics, technology, and imaging company. truRapid FOUR is a lateral flow test used to detect canine antibodies to Ehrlichia spp., Anaplasma spp., and Lyme C6, as well as heartworm antigen, using plasma, whole blood, or serum. (Source: https://www.businesswire.com/)

- In November 2023, the opening of a new UK veterinary diagnostics laboratory in Warwick was announced by Antech, the full-service veterinary diagnostics business that is part of the Science & Diagnostics division of Mars Petcare. UK veterinary professionals have a complete and flexible diagnostics portfolio that provides imaging, software, in-house diagnostics, and reference labs. (Source: https://www.mars.com)

Segments Covered in the Report

By Technology

- Clinical Biochemistry

- Clinical Chemistry Analyzers

- Glucose Monitoring

- Immunodiagnostics

- Hematology

- Molecular Diagnostics

- Urinalysis

- Others

By Animal Type

- Dogs

- Cats

- Equine

By Application

- Clinical Pathology

- Bacteriology

- Parasitology

- Others

By End-use

- Laboratories

- Veterinary Hospitals & Clinics

- Point-of-Care/in-House Testing

- Research Institutes and Universities

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Thank you for reading. You can also get individual chapter-wise sections or region-wise report versions, such as North America, Europe, or Asia Pacific.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/4387

Stay Ahead with Precedence Research Subscriptions

Unlock exclusive access to powerful market intelligence, real-time data, and forward-looking insights, tailored to your business. From trend tracking to competitive analysis, our subscription plans keep you informed, agile, and ahead of the curve.

Browse Our Subscription Plans@ https://www.precedenceresearch.com/get-a-subscription

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Trusted Data Partners:

Towards Healthcare | Towards Packaging | Towards Automotive | Towards Chem and Materials | Towards FnB | Towards Consumer Goods | Statifacts | Towards EV Solutions | Towards Dental | Nova One Advisor | Market Stats Insight

Get Recent News:

https://www.precedenceresearch.com/news

For the Latest Update Follow Us:

LinkedIn | Medium | Facebook | Twitter

✚ Related Topics You May Find Useful:

➡️ Companion Animal Health Market: Explore how preventive care, nutrition, and digital monitoring are transforming pet wellness globally

➡️ Animal Diagnostics Market: Examine how rapid testing and molecular diagnostics are advancing disease detection in livestock and pets

➡️ Veterinary Diagnostics Market: Discover how innovation in imaging and lab technologies is improving animal disease management

➡️ Companion Animal Drugs Market: See how growing pet ownership and chronic conditions are driving pharmaceutical demand

➡️ Veterinary Point-of-Care Diagnostics Market: Analyze how portable testing solutions are reshaping in-clinic and field diagnostics

➡️ Veterinary Biomarkers Market: Understand how biomarkers are enabling early diagnosis and personalized treatment in animal care

➡️ Veterinary Medicine Market: Track how innovation in vaccines and therapeutics supports animal health and food safety

➡️ Pet DNA Testing Market: Discover how genetic testing is enhancing breed insights, disease prediction, and personalized pet care

➡️ Pet Cancer Therapeutics Market: Learn how targeted therapies and immunotherapies are redefining cancer care for pets

➡️ Veterinary CRO and CDMO Market: Explore how outsourcing trends are accelerating R&D and product development in veterinary pharmaceuticals

➡️ Veterinary Antibiotics Market: Examine how antimicrobial stewardship and regulatory shifts are shaping antibiotic usage in animals

➡️ Artificial Intelligence in Animal Health Market: Gain insights into how AI is optimizing diagnostics, treatment, and farm management systems

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.